Pharma-SpecificTM Conjoint & Quantitative Research

Delivering evidence-based demand market research to the pharmaceutical industry

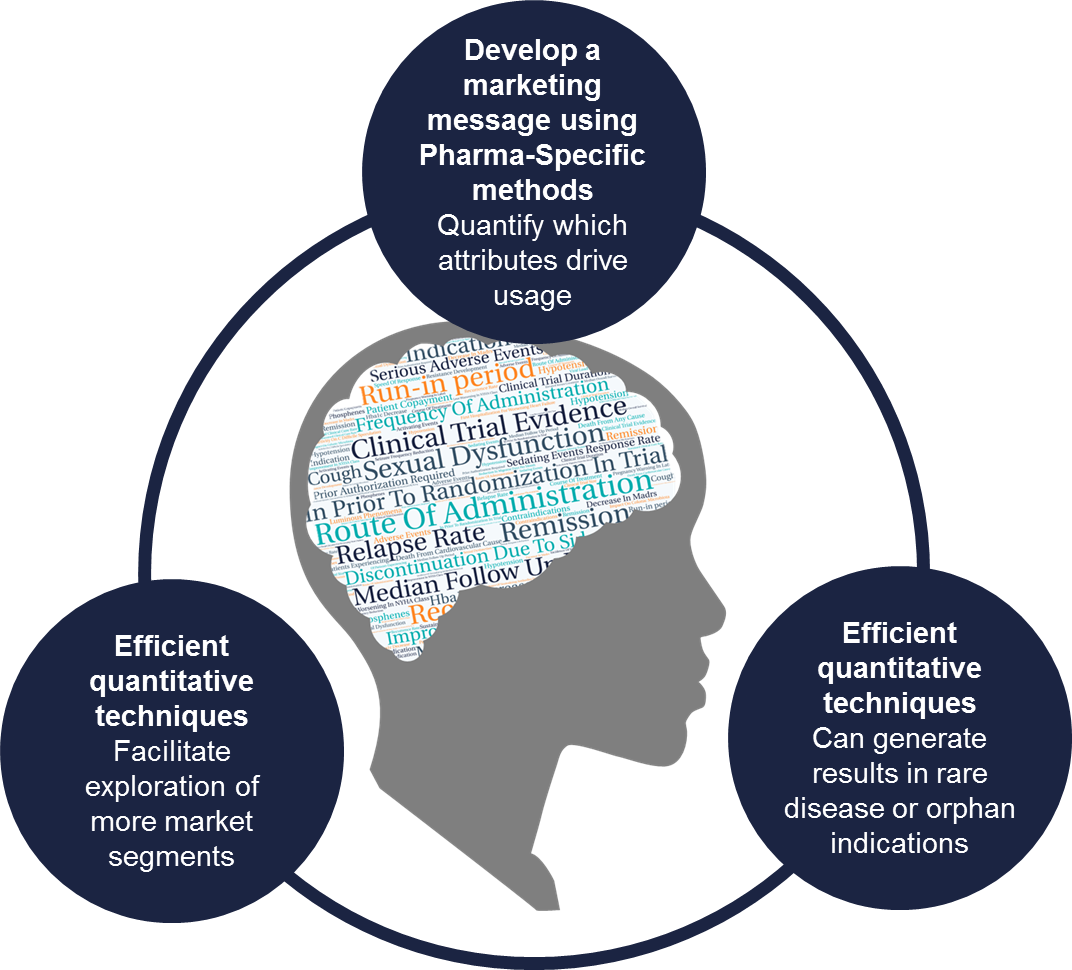

Pharma-Specific conjoint is designed to gain insights efficiently

Inpharmation’s Pharma-Specific quantitative market research platform has been developed to meet the unique requirements of pharmaceutical market research.

Pharma-Specific conjoint analysis is designed from the ground-up to offer the best results for pharmaceutical quantitative market research:

- Your analysis needs to be robust, so Inpharmation applies a pharma-specific conjoint analysis methodology that can achieve up to a 47% reduction in relative forecast error vs. traditional discrete choice-based conjoint analysis.*

- Respondents can be difficult to survey or low in number, so Inpharmation applies a pharma-specific conjoint analysis methodology that can achieve standard errors of <5% with only 20 respondents.**

- The answer to research questions frequently involves researching many market segments, so Inpharmation applies a pharma-specific conjoint analysis methodology with efficient powering, that means you can probe more market segments in your research window.

*Reduction in relative forecast error for pharma-specific conjoint (n=20) vs. best choice-based conjoint method (n=40).

**Standard error estimated based upon power calculations based on the spread of survey past responses.

%

Reduction in relative forecast error provided by Inpharmation’s pharma-specific self-explicated conjoint vs. discrete choice-based conjoint.*

Pharmaceutical conjoint analysis provides us with a model of the decision making process that doctors go through when they choose between competing drugs.

Almost all pharmaceutical conjoint studies use generic conjoint platforms that were developed to study markets like the cola market or the car market. They are – in many ways – inappropriate for pharmaceutical market research.

Inpharmation’s approach to pharmaceutical conjoint analysis is the only approach developed specifically to deal with the unique features of the pharma market:

- Sample sizes powered for pharmaceutical market research: because respondents (healthcare professionals, Payers etc.) in pharmaceutical market research are often harder to find and more expensive to survey, most pharma conjoint surveys are under-powered. Inpharmation’s Pharma-Specific Conjoint platform uses a conjoint method that delivers gold-standard accuracy, but with much smaller sample sizes.

- Conjoint has enormous benefits for pricing research: Inpharmation’s approach to conjoint research can provide valid price-demand estimates, whereas traditional approaches may only offer demand estimates. This means that you can see exactly which product features drive value and your value-demand estimate can be quickly updated as your TPP changes.

- Validated for pharmaceutical markets: because your forecast accuracy is of paramount importance, Inpharmation has validated our market research approach for pharmaceutical forecasts. This is important as agencies frequently use conjoint approaches proven to deliver biased results and that require hundreds of respondents (per country/segment) to deliver reliable results – both factors can make traditional conjoint-based approaches unsuitable for pharmaceutical research.

- Specific for pharmaceutical market research: Inpharmation has addressed the traditional issues with conjoint to develop Pharma-Specific Conjoint into a tool that regularly delivers unsurpassed insights in pharma pricing and demand research projects.

- Built for demand interactions: because pharma market shares are driven by more than a product profile (market entry order, promotional support, the impact of co-prescription, lines of therapy etc. are all important), Inpharmation’s Pharma-Specific Conjoint market simulator can handle the impact of all such drivers.

- Built for market access interactions: because market access is key to pharma sales, Inpharmation’s Pharma-Specific Conjoint research platform fully captures the impact of prescriber choice, market access and pricing in a single survey.

<%

S.E. (standard error) in conjoint based on only 20 respondents.**

"Europe's most respected pharma forecasting & pricing specialist consultancy."

Centre for Executive Leadership

Evidence-based conjoint & quantitative research

For the past two decades, Inpharmation has championed an approach to pharmaceutical conjoint analysis and quantitative market research that is built upon a solid evidence base. This means that all Inpharmation’s marketing research analysis is based upon:

- Methodologies shown to be accurate for pharmaceutical market research respondent populations.

- Methodologies that have been validated in many different therapy areas.

- Combinations of forecasting approaches based on two decades of evidence and validation.

Included in all Inpharmation’s international pricing project deliverables is industry leading training. 93% of pricing and market access course attendees highly rate our forecasting training.

.